4.4/5

4.4/5

4.7/5

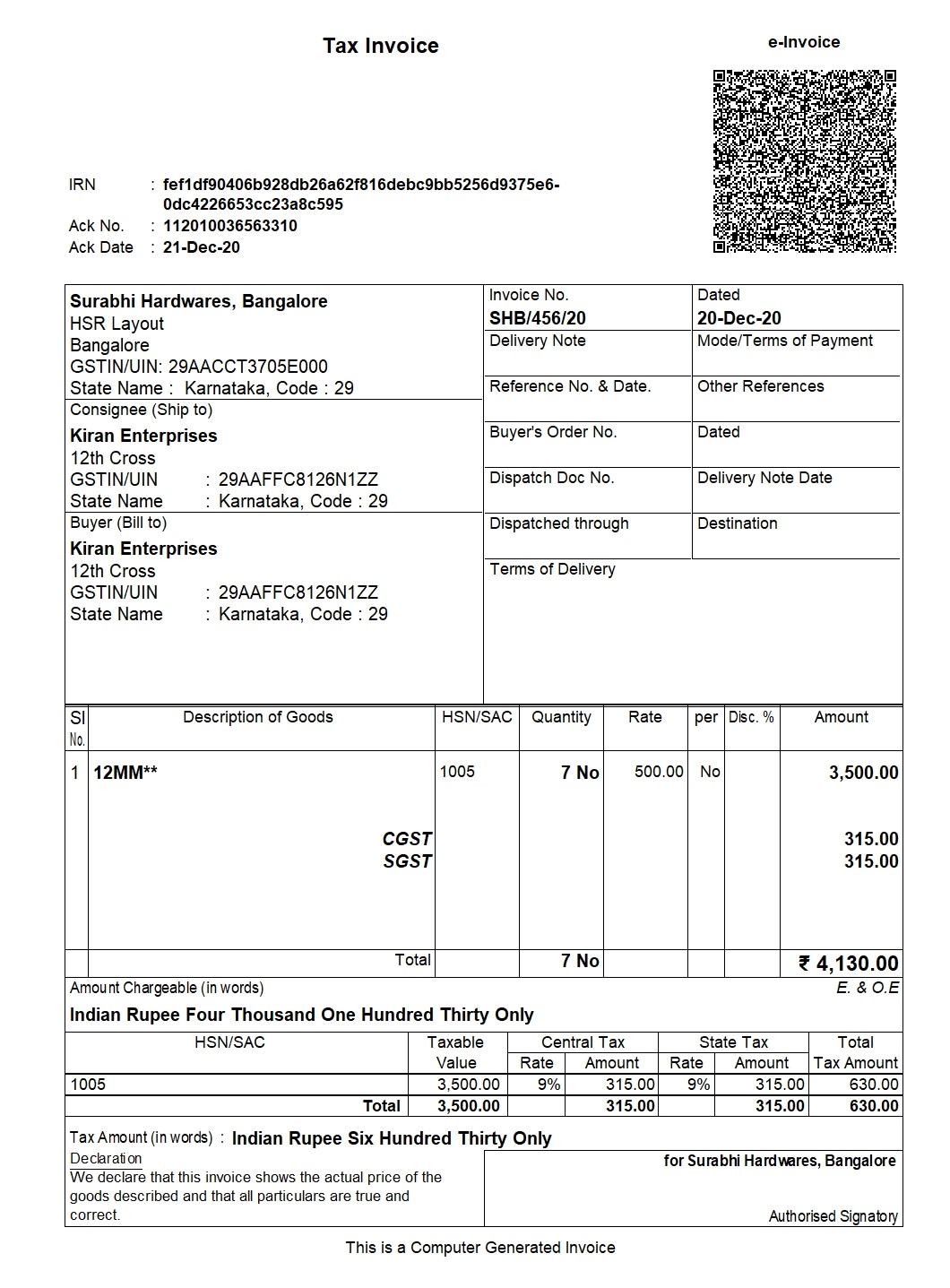

Tax invoice or GST Invoice is required to be issued by a registered taxable business showing the description of goods and/or services, value and tax, at the time of supply. It acts as the evidence of the existence of a transaction of supply of goods and/or services. Such invoices issued by the registered taxable person is an essential document to establish a time of supply and for the recipient of goods and/or services to avail input tax credit.

As per GST Act , a registered taxable person supplying taxable goods shall issue, at the time of supply, a tax invoice showing the description, quantity and value of goods, the tax charged thereon as prescribed.

Thus, the government has also provisioned free e-invoicing software for small businesses to help them be GST compliant.

Any invoice generator software should help businesses to create invoices as per the GST rules. Sales under GST can be of two types:

Before passing a sales entry in TallyPrime, we should first create ledgers relating to sales. Let’s first understand the creation of Ledgers.

One is required to first create the following types of sales ledger in their respective free invoice software and fill in the related information required to create these ledgers:

Note: Under Party account, you must also mention whether the party is composite dealer, consumer, registered or unregistered dealer.

Gateway of Tally > Vouchers > F8 (Sales). Alternatively, press Alt + G (Go To) > Create Voucher > press F8 (Sales).

In Party A/c name, select the customer ledger or the cash ledger

Select common sales ledger wherein the GST rate is not defined

Now, select the stock items defined with different GST rates, and specify the quantities and rates

Select the central and state tax ledgers. The GST will be calculated basis the GST rates mentioned in the stock items

Press Ctrl+O (Related Reports) > type or select GST – Tax Analysis to view the tax details. Press Alt+F5 (Detailed) to view the detailed break-up of tax

Press Alt+P (Print) > press Enter on Current > and press P (Print) to print

If you operating on TallyPrime 1.1.3 or earlier, follow the step:

Press Ctrl+I (More Details) > type or select GST – Tax Analysis to view the tax details. Press Alt+F5 (Detailed) to view the detailed break-up of tax.

To create multiple copies:

Any invoice maker software will have the provision to print invoices as per the GST rules.

In GST invoicing software, such as TallyPrime an invoice can be printed by just clicking Alt + P in the sales voucher screen. One can even customize the print configuration by pressing F 12.

To configure the printing of your sales invoice:

Businesses will need to adopt invoicing software. Be it a free online invoice software or the best free invoice software, you need to ensure that the invoicing software you use is GST compliant and helps you to carry on your business seamlessly.

Following are the mandatory fields that need to form part of each GST invoice format:

When a registered taxable person supplies taxable goods or services, a GST invoice is issued. To issue and receive a GST compliant invoice is a prerequisite to claim ITC. If a taxpayer does not issue such an invoice to his customer - who is a registered taxable person, his customer loses the ITC claim and the taxpayer loses its customers.

Watch Video on GST Compliant Invoices – TallyPrime GST Invoicing Software

Read More on GST

GST Rates & Charges

Types of GST

GST Returns